Student Loan Repayment

Everything You Need to Know About Paying Off Student Loans

Written by Shelby Scott Fintak

Graduation creeps a little closer every day. Sort of like an upcoming cliff you’re too busy pulling all-nighters, waiting in line for another cup of coffee or playing RuneScape to notice. But inevitably, we all fall off. Some of us swoop away on wings made of scholarship-gratitude, big fat thank-you’s to our parents for starting that college fund or stupid high starting salaries. But others of us fall into a pit of stinky, sticky, five-figure student-debt.

Say hello to the next 10 years of your life in five easy steps.

Step 1: (Denial) “Help me! I don’t know where to start and I can’t stop crying”

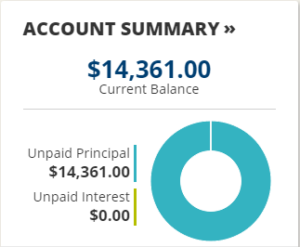

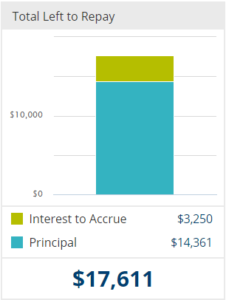

Much like the five stages of grief, figuring out how to pay off student loans starts with denial. You might’ve mistakenly glanced at the financial aid section of your university portal once or twice. And boy did that suck. $11,000? $37,000? $50,172? No thanks, I prefer not to think about that. Whatever amount Uncle Sam not-so altruistically let you borrow, you really need to know what you owe. Get comfortable with the number, because for the next 10 years or less, you’ll work to make it disappear.

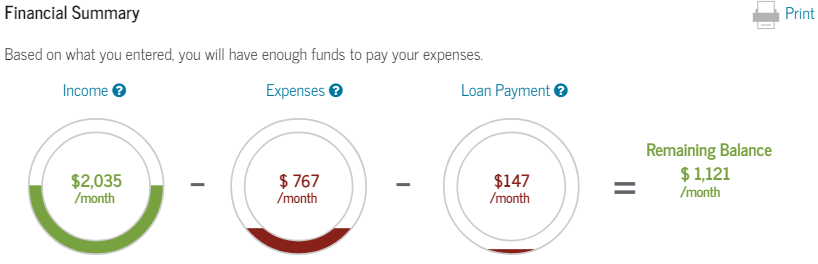

Find this information on your university portal, when you take exit counseling on FAFSA.gov or by creating an account on your loan servicer’s website. The last two will give you a clearer picture of your bank account’s future bleakness, so I recommend checking those. If you took any private loans or feel crazy enough to borrow for another degree program, you can factor those in to a repayment plan projection during exit counseling. This projection lets you estimate your future income and monthly expenses like groceries, rent, insurance and other bills to show you the impact of paying off your student loans. Play around with the inputs to see what kind of life you’ll have to start living on your most likely modest starting salary. Some of you might even be lucky enough to have money left over every month.

It might help to know the type of loan you borrowed as well. This lets you know when ol’ Betsy DeVos and her goons start tacking on interest and when they expect to start seeing repayments.Luckily, your loans grant you a six-month ‘grace period’ after graduation before you must start making payments. How thoughtful.

Well, there’s no use denying reality anymore. If you have student loans, you signed a Master Promissory Note legally binding you to pay something like thousands of dollars more than you borrowed. If you go more than 270 days without payment after your grace period, good ole Betsy DeVos expects the repayment in full. Immediately. Time to start looking for a job.

Step 2: (Anger) “They want me to pay how much every month? For how many months?”

Realizing how much four years of rent, tuition, Taco Bell, books and Natty Light really set you back might frustrate you. But interest accrual will drive you mad. If you’ve ever lived with a cuckoo clock, interest accrual will seem familiar, but instead of a wooden bird popping out every hour to say cuckoo, Betsy DeVos pops out once a day to swipe a dollar and some change from your bank account. Just close your eyes and look the other way. Actually, they just tack it on to the grand total of your loans that you pay a chunk of every month.

The federal government supports the people. But much like a mobster, when they want their money back, they ain’t playin’. Terms like capitalized interest, acceleration, delinquency and default should be avoided like the plague. So pick a payment plan and stick to it. When you complete exit counseling, required by most universities, you choose the plan that sounds like it should work for a while. All repayment plans last 10 years max. If you plan to play with the long con in mind (i.e. “I don’t got it now, but when I got it, you’ll get it”), gradually increase your monthly payments (and total interest paid) with a graduated repayment plan. Looking to pay as little interest as possible? Choose a standard repayment plan, get the total amount owed down faster and end up paying less (in interest) overall. You can change your plan by contacting your loan servicer.

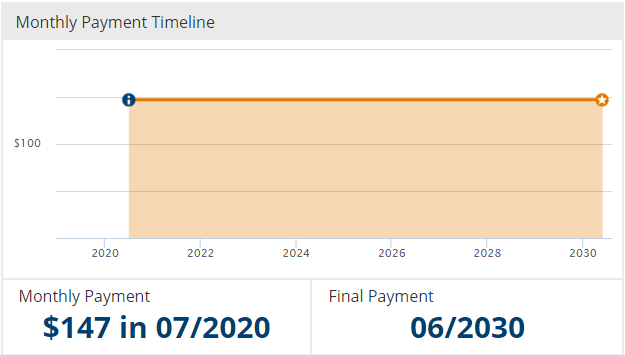

FAFSA’s exit counseling also offers a feature that lets you visualize the monthly impact of your loan payments. If you can project into the future and imagine your salary, rent, utilities, monthly grocery costs, health and car insurance, car note, gas and emergency fund wherever you end up moving after graduation then this tool is extremely useful. But most likely, this won’t be accurate. Unless you bike everywhere, stay on your parent’s insurance and get a few roommates.

Step 3: (Bargaining) “What if I pay off my loans in less than 10 years?”

Image the year 2025. You’ve been out of college almost six years, longer than you were there. You’ve visited three continents, earned a blackbelt, moved to Las Vegas and married a dancer for 42-hours, learned another language, met the love of your life and still make payments on that intro to communications class you took back in 2016. Gross. There must be another way.

Although all repayment plans max out at 10 years, you can pay off your student loans at any time. Just a matter of having the dough. Making payments with that part-time Panera money on your Direct Unsubsidized and Direct PLUS Loans before you have to will save you money and speed up the process. These types of loans start adding interest the day you get them, unlike subsidized loans which accrue interest six-months after you graduate or unenroll. Paying more than you have to and/or before you have to will get the burden off your back a little faster. The less you have left to pay, the less your daily interest add-ons will total.

Save even more by working full-time as a teacher at certain schools or in public service. Take a measly 0.25% off the daily interest you pay when you elect to have payments withdrawn from your bank account automatically. Win the lottery the day after graduation, pay them off in full before interest can accrue and never think about them again. Fingers crossed.

Step 4: (Depression) “So I’m realistically looking at paying off student loans for more than twice as long as I was in school. Wow”

Nothing more to say on that really. Graduate, pick your plan, get a job and pay.

Not to scare you, but paying off student loans affects many parts of your life. Mess up the payments, mess up your credit score. Want to move out? You have a bad credit score. Exit counseling really hammers home the importance of paying off your loans. Make a plan, keep your documents and stay on top of your finances. If you can’t make a payment, make sure you see it coming. Contact your loan servicer and let them know what’s up before the due date and work out another payment option. Ask the U.S. Department of Education for permission, not forgiveness.

Step 5: (Acceptance) “Well, what’s borrowed is borrowed”

The silver lining, if you must, is that many Americans owe lots of money to the government too. We all get booted into the real world, some sooner than others, some with $100,000 worth of student debt, but all booted nonetheless. You can do anything you put your mind to. I mean look at Betsy DeVos.

Set financial goals and hold yourself to them.

- Stop overspending on junk.

- Put some money in your savings.

- Establish good credit by making payments on time.

- Do some research to find insurance, rent and car payments you can actually afford every month.

- Enjoy the simple (free) things in life.

Step 6: (Solace) “Bring it in for a hug y’all”

“I think that being loan-free so far has definitely made me feel more accountable with how I allocate my resources and not waste opportunities that come about for me,” said FSU senior Mark Toussaint. “It also caused me to adopt a long-term mindset when dealing with money in general.”

“Owing the government thousands of dollars to get a degree that doesn’t even guarantee me a job with which I can pay my loans off makes feel like nobody actually cares about me getting an education,” said FSU senior Taylor Bonachea, “it makes me feel used and abused by Uncle Sam.”

“I owe like $30,000. I guess I feel nervous and hopeful that my degree was worth the four years of borrowing,” said Methodist University senior Jonathan Fintak. “Overall, [I feel] slightly discouraged about owing money when I graduate.”

“[Owing the government money] makes me question whether the education I’m getting is better than the starving artist lifestyle that our society has decided is a representation of failure,” said Hunter College graduate student Cody Shook.

“I owe about $55,000 and I guess I feel alright with it,” said FSU senior Maeghan Eaton. “I’m more upset about how much school costs in general and how important education is… They want to educate you, it’s the financing and the fact that they also want your money that is frustrating.”

“Through grants and scholarships, I’ve been able to enjoy my college experience, focusing on my craft and being fully engaged in my work without debt hanging over my head 24/7,” said UCF junior Marissa Jennings. “It’s an experience I wish every student could have.”

“To be honest, getting student loans was more of a strategic choice for me,” said UF senior Auhria Newton-Reynolds. “I always was terrified of loans. There are some super negative connotations around it, but with a lot of research and a strong belief in my capability to repay them, I took them.”

“My family saved up to afford school. Bright futures and Florida prepaid covered most of it though, so it was more convenient and definitely took some stress off of graduating because I didn’t have to worry about loans,” said UF alumna Weston Hucknall.

“Lmao I’ve hardly thought about how I’m going to pay rent,” said FSU senior Frankie Kassay.