How to Buy a Car

How to Buy a Car Without Going Bankrupt

Written by Kaitlyn Tang

After landing your first full-time job, you have worked hard and long enough that the dollar amount in your bank account hasn’t made you want to cry in a long time. After months of tiresome commuting via public transportation or getting rides from parents, you decide you would like to buy a car. However, you don’t know the first thing about getting a car.

The steps to getting that new car in your driveway may seem tedious, but they will insure that you get a solid car in your hands for an affordable price.

1. Scope out all the options and specs

First and foremost, you must be over 18 or 21, depending on the state, to purchase a car. If you can’t even vote yet, the dealership will likely turn you away at the door. Your newly gained adult ego still fervently desires a car to call all yours, but they will probably ask for a co-signer, either a parent or guardian, to take on financial responsibility in case you cannot fulfill the payment.

If you at least voted at the most recent election, let’s talk. Before you even decide what kind of car you want, you should decide how much money you want to spend on it up front. Often times, how much money you want to spend on your car will go hand-in-hand with what car you want to buy. “I had about 18 to 20 thousand in my bank account before I thought about purchasing a new car. I’ve always had a soft spot for Mini Coopers, I’ve always wanted one since I was younger, so I knew which car I wanted to buy long before I had the money saved up,” Ohio University graduate Aaron Leung said. Of course, aim for a car that lands reasonably within your price range. If you have $5,000 in the bank, I wouldn’t advise shooting for that Bentley as your first car.

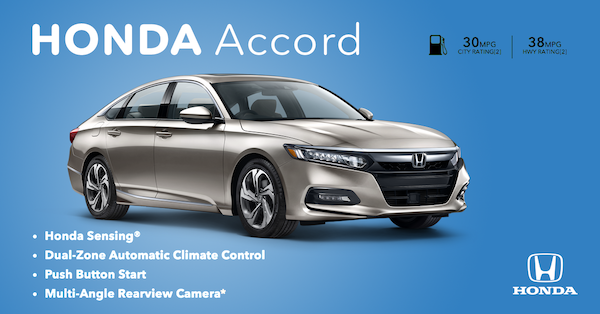

While you still shop around, endless possibilities lie ahead at edmunds.com, truecar.com and kbb.com. These websites compare all the different choices: sedan, truck, SUV, coup and more. You’ll also see the phrase “make and model” often; make refers to the car company producing the car like Honda, Toyota and Kia, and model refers to the specific type of car each company sells, such as a Honda Civic or a Honda Accord. Other options to explore on the websites also include the year, special features (like heated seats) and pricing.

2. Know what price to expect for your car

On these websites, you’ll notice the pricing of the car you choose will appear as a range of several thousand dollars. Don’t worry, the site didn’t break down. You’ll see the words “listing price” or MSRP as you explore the website. The Manufacturer’s Suggested Retail Price refers to the standard listing price a car company sells the car. For the sake of clarity, pretend I want to buy a Honda Civic. The MSRP of a Honda Civic on edmunds.com starts at around $20,000, not a bad start.

Back in the day, people used to pay at or close to the MSRP. A dealership usually pays a car company for the car at a lower price called the dealer invoice price. If Honda of Santa Monica paid Honda the invoice price of $18,000 and sells the car for $20,000, the dealership pockets the $2,000. After the invention of the internet people easily found out the invoice price, so these days customers usually negotiate around the invoice price. “The car I ended up with is actually a 2012 Camry instead of the 2006 because we considered how a newer model is safer and can be used longer. The price listed was $8,300 but the final price we agreed on was $7,500,” University of California, Santa Barbara senior Michelle Kang said. People typically pay several hundred dollars above or below the invoice price, depending on how aggressively your dealer negotiates.

The time of year also comes into play with the price you can negotiate it to; the closer to the release date of the car you negotiate, the harder time you’ll have talking down the price. However, if you start negotiating near the end of the year, right before the company releases the next year’s model, you might get it closer or even below the invoice price.

3. If you want to buy a used car, make sure to check up on car reports

If you decide you would like to buy a used car, you must make sure the shady dude selling his Beemer out of his garage won’t cheat you out of your money. You definitely need to get a car report. A car report records the history of a car: when the company produced it, registration, maintenance records, any service done (like major engine failure and such), accidents, miles, manufacturer recall and if the owner sold it to someone else. “I discussed buying a car with my dad because I needed one for my summer internship…Decisions were made quickly due to my circumstances but I definitely think it’s worth it to take your time and make the right decision. I wish I had the chance to take longer to make the decision because we bought the car without checking with a mechanic so there might be hidden problems with the car we were unaware of,” Kang said. You can find car reports on websites like carfax.com and autocheck.com.

We don’t want your car to stop running in the middle of the freeway now, do we? You should get a car report to know the health of a used car before you buy it, so you can make sure you buy a healthy car with little to no troubles or accidents. “I took months to find a car because we needed to sift through all of the Craigslist posts to find the ones that mattered,” UCLA graduate Brian Louie said. A lot of private sellers will present the car report once you express interest in their car. If not, you can just ask for the VIN number, the Vehicle Identification Number, send it to a website like carfax.com, pay a fee and it will produce a car report for you.

4. Compare dealership deals

In the dinosaur years, people used to go to different dealerships and compare prices in person, but like I said before, the internet has dramatically changed car shopping. The first option allows you never to leave your own room and laptop. On websites like edmunds.com and cardirect.com you can enter in your preferred make, model, year and features, then submit your email address. The websites will contact dealerships, with connections to the websites, in your area. The dealerships will probably contact within the next day or so with suggested prices. After that you start negotiating over email.

Everybody loves Costco right? The awesome samples, the appealing smells of salt and grease coming from the cafeteria outside. If you shop there, then you definitely already have a membership with them, and this second option, only for Costco members, will only make you love them more. Costco has a buying program called the Costco Auto Program offering pre-discounted cars from selected dealerships, offering most makes and different models. Once you have entered in your preferred make, model, color and features, click the “locate dealer” button, and they’ll connect you with the selected dealerships that partner with them. “I [negotiated] in person, but I first got a price confirmed on Costco pricing so I didn’t have to haggle. But unless you go this route, it’s always better to email first to get a price, but you will almost always have to do additional haggling once you arrive in person,” Columbia University School of International and Public Affairs graduate Kenneth Hau said. It might sound too easy, but like always Costco usually has the best deals.

However, sometimes aggression pays well. If you really know what you want and feel confident that you can negotiate on your own, you could email the dealerships yourself. Simply go to the website of the dealerships near you (Honda of Santa Monica), go to the staff page and look for people listed as internet sales. Email one of those guys with the car you want and how much you want to pay for it. Of course, some dealers might consider your offer too high and will either say no or never respond. If nothing lucrative comes from it, you can simply move onto the next dealership.

Some people don’t like hassle or suck at using technology (admittedly me), so all this internet and websites talk might not appeal to you. In that case, you could literally walk into a dealership, negotiate in person, sign the paperwork and walk out with a new car—all in the span of a few hours. “I negotiated in person before purchasing the car, [and] I was able to get a few thousand off the sticker price. My car shopping experience took two days; I think it went quickly because I knew what I wanted ahead of time,” Leung said. People who like to touch and feel usually go for this option. If you have a hard time saying no to someone in person, I recommend sticking to negotiating online.

5. Time to meet your new best friend (read dealer) IRL

You have emailed your dealer so much that the number of emails in your thread now exceed a horrifying 47, and the two of you finally reach an agreement on the price of your car. Don’t forget that while shopping around for your preferred make and model you can always test drive the car, just to make sure you like how it feels when you drive it. Of course, when you know you love your car and you love the price, you can finally walk into the dealership. Just sign some paperwork and you can drive your car home.

6. But wait, how do you pay for the car?

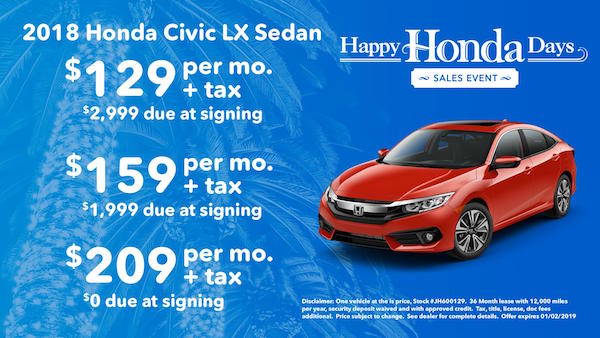

Remember I said you should have a a solid amount of dough in the bank before you start shopping? Well that comes into play while signing the paperwork at the dealership when you discuss financing. Let us say you negotiate like a pro and got the price of the car down to $18,300, pretty close to the invoice price. In a perfect world, you would have $18,300 in your bank account saved up, and pay in full. No headache and no hassle. However, young adults rarely have that much saved in the bank account, so after paying a down payment we have to finance the car, basically pay it in installments. Financing typically lasts from three to up to seven years. “I chose the shortest amount of time possible. I knew I didn’t want to have an endless amount of car payments, so I chose to finance for 5 years and put 7 thousand as a down payment. I didn’t like the idea of paying a lot of interest,” Leung said. The amount of time you choose to finance it just depends on how much money you can spare each month to pay it.

However, like most loans, the dealership will charge you interest just for financing the car. The dealership has to make money somehow, right? The interest rate typically ranges from 0.9% to 8%, and this depends on your credit score. Yes, the infamous credit score that you can never run away from. If you don’t have a credit score, like many young people out there, or you don’t have enough money for even a down payment, the dealership will ask you to have a co-signer sign the dotted line. Try not to run away to Tijuana or else you’ll majorly piss off your mom.

Still following our example, if you have $5,000 you feel good spending on the car, you put that down as a deposit. You still need $13,300 to buy the car, so you finance it for 5 years. You take the principle, $13,300 divided by 60 months (12 months multiplied by five years) plus the interest rate, and you pay that much per month for the next five years. Now you can drive your car home.

Buying a car takes a lot of thinking, planning, considering and saving. “Overall, it took around a month and a half to finally purchase a car… I had to narrow down what car I wanted and also what trim I would be happy with. Since I was buying the car and would be using it for a long time, I didn’t want to regret my decision,” California State Polytechnic University, Pomona graduate Brandon Choi said. If all of this seems like too great a headache and you don’t think you have enough money, perhaps you shouldn’t buy a car quite yet. Nevertheless, after all that you’ll definitely come to treasure your new car as your new baby. Take it for a quick spin around the block, you deserve to enjoy it.