Credit Score 101

Credit Score: Everything You Need to Know

by: Kylie Kirschner

Credit scores are complicated. You’ll find there are a lot of factors that determine your score, a lot of reasons why you might need one and more than one way for agencies to calculate your score to begin with. A lot of terms get thrown around. When you try to figure out what to do with your life, it can end up just being another thing that makes life confusing.

So, why is your credit score important?

Your credit score might seem like something you won’t need until much later down the road, but it can affect things like student loans and how easy or hard it is to get an apartment or a car. Also, the length of your credit history affects your credit score, so it’s a good idea to start early. Research also shows that even just knowing your credit score and keeping track of it is correlated with better financial decision-making.

What even is a credit score?

In simplest terms, a credit score is a three digit number that summarizes how creditworthy a person is. It’s used by lenders, like banks and credit card companies, to evaluate how much of a risk they’d be taking in lending a person money. In other words, it shows them the likelihood of you paying your bills. Your credit score helps those lenders decide if you qualify for a loan or not, at what interest rate and the limit to how much they will lend you.

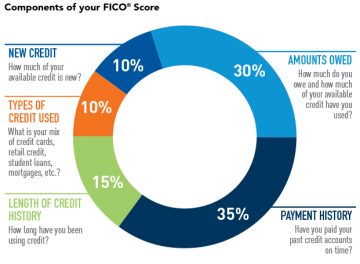

A number of factors affect your credit. The most important of these is payment history: do you pay your bills on time? If you’ve paid late before, exactly how late? How often have you missed a payment, and how recently? Lenders want to know if and how reliably you’ll pay them back.

The next most important factor is how much you owe: generally, it’s better to owe less because you seem more responsible, but owing some and paying it back on time shows lenders that you’re reliable and financially stable. For example, let’s say you have a $60 balance on a credit card with a $500 limit, while your friend has a $4000 balance on a card with a $5000 limit. You’re going to seem more responsible than your friend to potential lenders, but as long as you’re both paying your bills on time, you’ll both seem more dependable than your third friend who has no credit history at all.

Of course, there’s the length of your credit history: you might be reliable in paying your bills, but how long have you been reliable? How many accounts do you have, and how long have you had them? Even if you’ve been paying off your bill on time every month for the two years since you got your credit card, your credit score probably won’t be as good as your parents’ credit scores if they’ve been paying off their bills on time for the past 30 years.

How do I know if my credit score is good or bad?

The highest credit score you can have is 850—generally, lenders consider scores between 800 and 850 exceptional, scores from 740-800 very good, 670-740 good, 580-670 fair, and anything under 580 poor. If you have no credit at all, or an extremely low score, you probably just haven’t established a credit score or don’t have a credit history at all.

You might’ve heard the terms FICO score (named for the Fair Isaac Corporation that created it) or VantageScore before: These are two of the most common credit score scoring models. Credit bureaus select different characteristics of a person’s financial behavior and use statistical analysis to evaluate how creditworthy that person is—those factors are weighted differently depending on the scoring model’s formula. Your credit score will actually vary depending on which scoring model is used and which credit bureau your information is pulled from. Don’t worry about this too much though—as long as you’ve been generally smart and consistent in your financial behavior, you should be in good shape all around.

How do I build credit?

Even as a college student, you can start building good credit. Dr. Tatiana Homonoff, a Professor of Economics and Public Policy at NYU who conducted the research referenced earlier using data from 400,000 student loan borrowers, emphasizes the importance of credit history.

“For young borrowers, it is important to establish credit history—have a credit card or some other line of credit,” Homonoff says. “It’s also important to make sure that you do not make late payments—if you cannot pay off your whole balance, make sure you pay at least the minimum, which is often as low as $15, to maintain a good payment history.”

You can use a credit card (and make on-time payments) as the easiest way to establish credit, especially as a student, but you can find other ways to build credit, too. Making payments to pay off loans (like student loans) consistently over time will help build your credit, and if you have an apartment, your history of rental payments factors into some scores. Even utility companies in some states report payment histories to the credit bureaus.

Now what?

So, you know what it is, why you need it, and how to build it. Now, how do you check your own?

Luckily, we have access to a ton of options for checking your credit score for free. If you have a credit card, most banks allow account-holders to check their credit scores from at least one credit reporting agency through their accounts. There are also a whole host of non-bank website options like Credit.com, Credit Sesame, Credit Karma, and Mint that allow you to get your credit score—just know that these websites might not have the same data protection that banks have. You can also request your credit score directly from each credit reporting agency once every year.

Some surveys show that 30-40% of American adults don’t even know their scores, or how their score is calculated. Even just knowing what your own credit score is and how it works is the first step toward a responsible financial future. Now that you know, what will you do next?

Credit Score Articles

Read our latest credit score articles below.