Some people say “money can’t buy happiness,” and those people probably weren’t struggling college students with 50 cents in their bank accounts. Money may not buy happiness but it sure can buy things that make you happy, like grabbing drinks with some friends or at least a cozy apartment and a sustainable amount of groceries. However, most students have difficulties when it comes to handling and budgeting their money. These few basic tips will help you understand how to manage your money properly throughout college and after graduation.

Check out the basics:

1. Balance Your Income

The first step to creating a budget is understanding why you need one. “Many Americans do not budget or understand how to balance what they consume with what they earn,” Florida State University Professor of Finance April Knill said. Think about what you buy every month. Do you spend more on groceries and rent or clothes and eating out?

The key to balancing your budget is differentiating between a necessity and a want, even if a want seems like a necessity in the heat of the moment. Cutting back what you splurge on clothing and eating out will help you save money in the long run. Next time you have a craving for new clothes or a sweet tooth for some ice cream, ask yourself if you really need it or just want it. You can also try making a shopping list of things you need before you leave your house so that you don’t make any impulsive purchases. If you’ve tried lists before and didn’t have any luck, try using a budgeting app like Pluto or EveryDollar that help you set and reach goals and limit your frivolous spending.

2. Start Debt Free

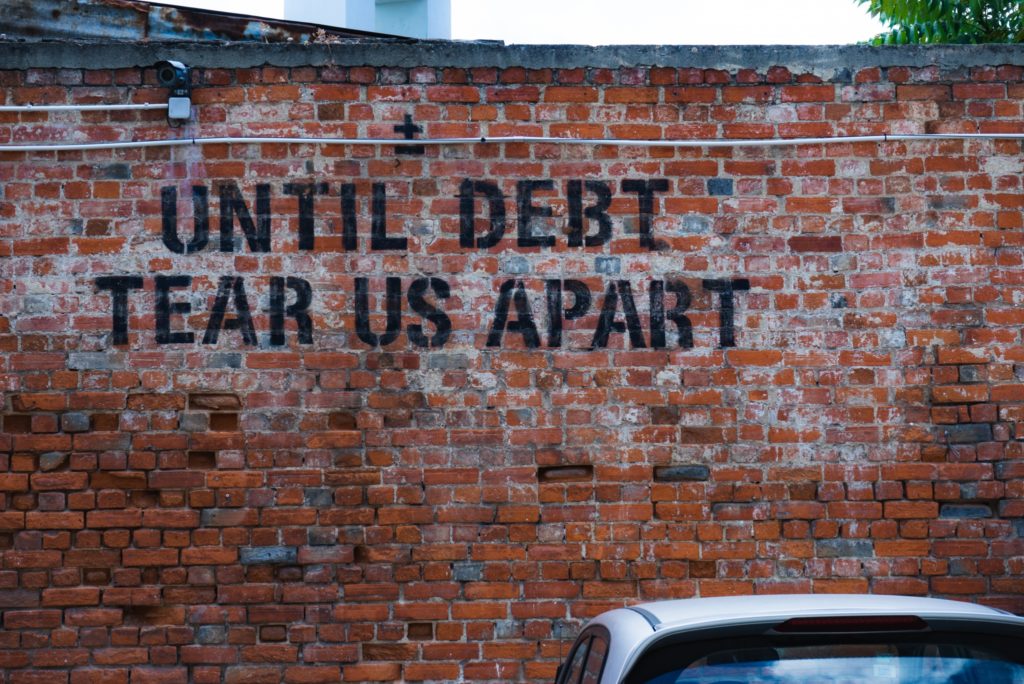

While it may feel like you’re struggling with your money on a month to month basis, you’re probably still living within a comfortable standard of living. You’ve got a roof over your head—hopefully—you can afford groceries and the occasional night out with friends. There’s a lot you don’t have to worry about yet like mortgage payments or medical bills. “The biggest thing I tell my students to do is take advantage of their standard of living right now,” Knill said. However, ‘spend how you like when you like’ isn’t the point to take from this. “Given that they’re students, most of whom do not work full-time, their annual income is quite low. Getting that first full-time job and the related bump in pay is a once-in-a-lifetime opportunity,” Knill said.

Take advantage of this once-in-a-lifetime pay bump so that you can get ahead of any debt you have and invest in your future. “I recommend that they invest as much as they can in retirement and that they do their best to pay off any credit card debt as quickly as they can and then save using whatever they were throwing into their credit card bill,” Knill said. Not only will this help you financially in the long run, but it will relieve the stress that long term debt can cause.

3. Protect Yourself from Yourself

“Anyone can grow into any income so you need to protect yourself from yourself.”

Just like a diet, you need to have will-power when making purchases. Eat a salad instead of a burger, save your money instead of spending it. “Set yourself up for living below your means,” Knill said. “Take advantage of direct deposit by employers. Many offer multiple destination accounts so they can put enough in their main account to pay all their bills and then send an amount meant for savings to a bank account that is not convenient like a credit union that doesn’t have a lot of ATMs around. Make it as inconvenient as possible to take money out.” Pay your bills and save money on unnecessary purchases, like $20 on Chinese take-out when you already stocked up on groceries. It becomes more difficult to spend frivolously which makes it easier to save.

4. Plan Everything Out

While most of us hated learning and using excel throughout our schooling years, it’s actually a helpful resource when it comes to handling and planning your budget. Laying out your finances in advance allows you to plan accordingly and realistically see what you can afford. Seeing it all laid out in front of you in a spreadsheet or even just in a list can put things in a financial perspective. Checking your bank account every now and then to see if you can afford a night out with friends doesn’t count as monthly budgeting. Use a platform like excel to lay out all of your monthly needs next to your income to see what money you have to spend after the necessities are taken care of. We’ve all had those months of binge spending, eating out and treating ourselves too much then panicking when rent came around, but plan ahead and you won’t have to panic ever again.

A Week on a College Student Budget: Rocky Mountain Style

A Week on a College Student Budget: Rocky Mountain Style